This news release constitutes a “designated news release” for the

purposes of CAPREIT’s prospectus supplement dated May 15, 2025, to its

short form base shelf prospectus dated May 15, 2025.

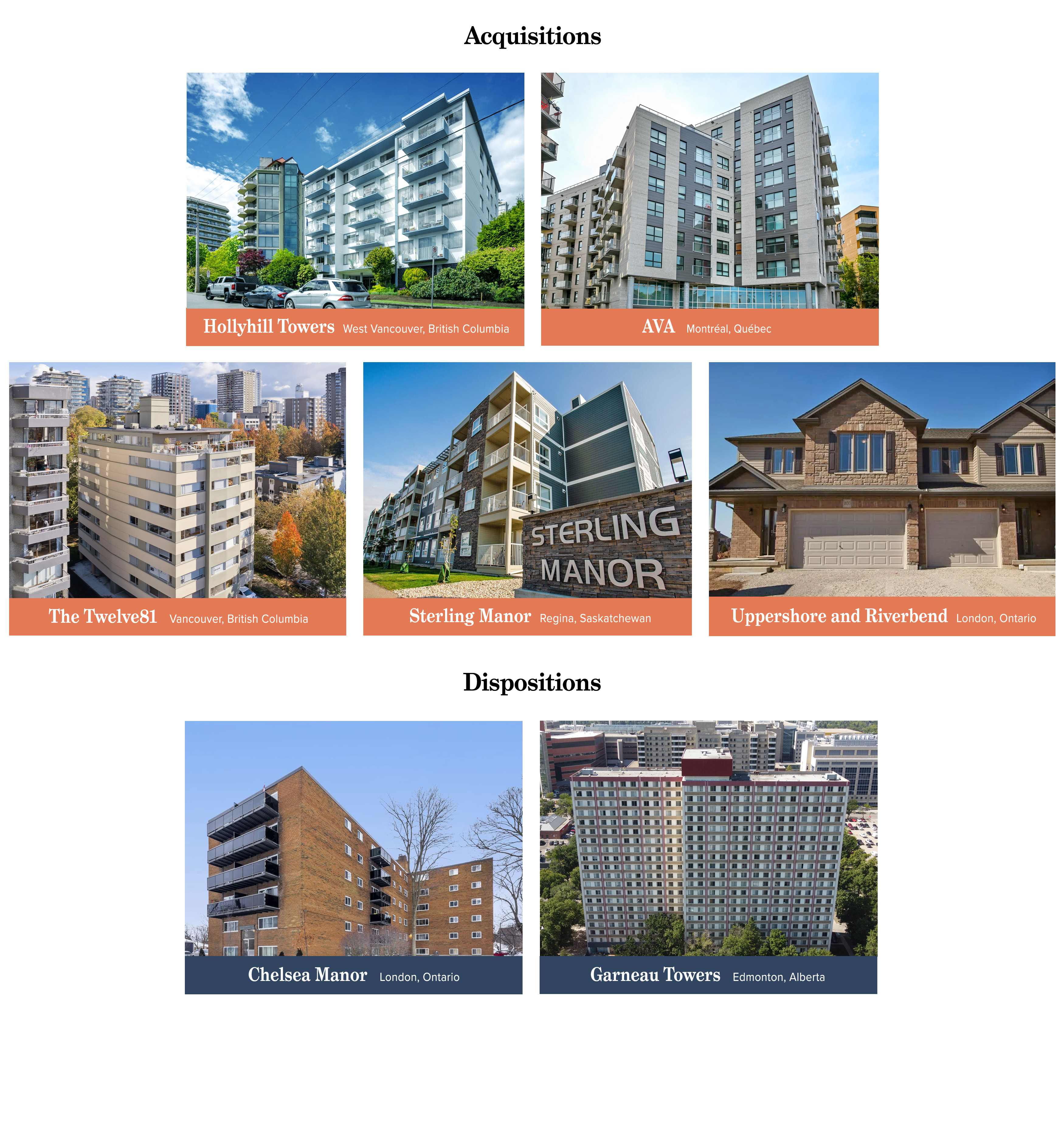

TORONTO, Sept. 03, 2025 (GLOBE NEWSWIRE) -- Canadian Apartment Properties

Real Estate Investment Trust (“CAPREIT”) (TSX: CAR.UN)

announced today that since the second quarter of 2025, it has closed on, or

has entered into agreements to close on, the acquisition of five

strategically aligned rental apartment properties in Canada for an aggregate

purchase price of $214.0 million. CAPREIT also announced that it has closed

on two non-core Canadian dispositions for combined gross proceeds of $82.5

million. All amounts disclosed herein exclude transaction costs and other

customary adjustments.

So far in the third quarter of 2025, CAPREIT has completed the acquisition

of three high-quality, on-strategy Canadian rental properties:

-

In July, CAPREIT acquired a 30-suite rental property centrally located in

the highly sought-after city of West Vancouver, British Columbia. At this

widely coveted location, residents enjoy unique, panoramic views of

Stanley Park, Mount Baker, Vancouver Island and the North Shore Mountains.

The acquisition has allowed CAPREIT to expand its presence into the most

affluent municipality in Canada, where the average household net worth is

in excess of $4 million, and where there is limited new construction and

supply. This reinforces the value embedded in the fully leased property,

providing for a stable runway of long-term growth. The property was

purchased for $13.0 million, and CAPREIT assumed the existing $6.1 million

mortgage, which carries interest at a stated rate of 4.1% per annum for a

remaining term to maturity of approximately 8 years.

-

In August, CAPREIT closed on the purchase of a 10-storey rental property

containing 121 spacious, premium-quality residential suites located in

Montréal, Québec. The building is primely situated in the

Côte-des-Neiges-Notre-Dame-De-Grâce (CDN-NDG) borough, surrounded by a

dense retail offering and located just east of Highway 15, and less than

10 minutes walking distance from De la Savane and Namur metro stations.

The amenity-rich property, which includes a rooftop pool, fully equipped

gym, indoor lounge and outdoor terrace, was built by a reputable developer

in 2024 and was purchased unencumbered for $54.5 million.

-

In September, another high-quality 31-suite property was purchased in

Vancouver’s trophy West End neighbourhood, near the Central Business

District, Sunset Beach and Stanley Park. Its core location provides close

access to the beach, Burrard Street Bridge and public transportation

routes, and it is situated adjacent to another recent CAPREIT acquisition

in this exclusive, high-end node of Vancouver. With persistent population

growth in the area, the strategically aligned property’s embedded value

enhances the quality and stability of CAPREIT’s future earnings. The

exceptionally located building was purchased for $14.0 million, and

CAPREIT assumed the existing $5.8 million mortgage, carrying interest at a

stated rate of 4.2% per annum for a remaining term to maturity of

approximately 4 years.

CAPREIT further announced that it has entered into agreements to purchase

two additional recently constructed rental properties in Canada:

-

The first site was built in 2014 in Regina, Saskatchewan, containing 320

modern residential suites. Based in the Greens on Gardiner neighbourhood

of southeast Regina, the property is situated in close proximity to public

transit, schools, parks, the shopping centre and the newly opened bypass.

At this convenient location, residents enjoy easy access to downtown

Regina (17-minute drive) and a short walk to Green Meadow Park (16

minutes). The property boasts large average suite sizes with contemporary

finishes, and a range of amenities including an outdoor pool, fitness

centre, games room, community fire pit and barbeque area. CAPREIT expects

to acquire the asset for gross consideration of $76.3 million, and assume

the combined $37.3 million in mortgages, carrying interest at a stated

blended rate of 2.1% per annum for a remaining weighted average term to

maturity of approximately 6 years. Closing is anticipated later in

September 2025.

-

CAPREIT entered into another agreement to purchase 162 residential

townhome suites built in 2012 and 2015 in London, Ontario. The peaceful,

suburban location benefits from close proximity to Riverbend Park, Kains

Woods trails, and several reputable schools, as well as nearby shopping,

dining and golf facilities. CAPREIT has agreed to acquire the property for

$56.2 million, and assume the combined $24.0 million in mortgages, which

carry interest at a stated blended rate of 3.0% for a remaining term to

maturity of approximately 4 years. Closing is anticipated in October

2025.

A Media Snippet accompanying this announcement is available by clicking

on this link.

CAPREIT also announced that in August, it completed two dispositions of

non-core properties:

-

A residential property with 59 suites built in 1970 in London, Ontario,

was sold for $11.8 million, with part of the net proceeds used to repay

the outstanding $4.3 million mortgage.

-

An unencumbered property in Edmonton, Alberta, containing 309 residential

suites, constructed in 1965, was sold for $70.7 million in gross

consideration.

“We’re proud to see these transactions bring us to $366 million of

investment into the Canadian housing market so far in 2025, which we’ve

effectively funded through $357 million worth of our non-core dispositions

in Canada,”

commented Mark Kenney, President and Chief Executive Officer.

“We’re trading properties that have low cash flow yields and high

operational challenges, for premium rental apartments located in widely

sought-after, top-tier neighbourhoods within Canada’s most attractive

cities. Through this repositioning strategy, we’re enhancing the quality

of our portfolio, cash flow profile and long-run earnings for unitholders,

while also infusing capital and supporting affordable housing in the

market, which importantly benefits the broader residential real estate

landscape in Canada.”

“Our strategy is focused on recycling capital into high-quality,

high-performing properties situated in high-demand areas that have strong

long-term growth prospects,”

added Julian Schonfeldt, Chief Investment Officer.

“These transactions demonstrate how we’re able to improve our portfolio

quality while enhancing cash flow. As an example, the acquisition of the

recently constructed Sterling Manor is at a slightly higher capitalization

rate than the sale of the 60-year-old Garneau Towers, which improves net

operating income, but importantly, with a fraction of the capex

requirement, and a noticeable upgrade to CAPREIT’s portfolio quality.

Additionally, Garneau Towers was unencumbered, whereas Sterling Manor has

attractive below-market debt. We’re excited to continue recycling our

capital in this productive manner, improving our performance and growing

cash flow for unitholders through executing on this tried-and-tested

repositioning strategy, and we look forward to making further progress in

2025.”

ABOUT CAPREIT

CAPREIT is Canada's largest publicly

traded provider of quality rental housing. As at June 30, 2025, CAPREIT owns

approximately 45,400 (excluding approximately 1,600 suites classified as

assets held for sale) residential apartment suites and townhomes that are

well-located across Canada and the Netherlands, with a total fair value of

approximately $14.5 billion (excluding approximately $0.6 billion of assets

held for sale). For more information about CAPREIT, its business and its

investment highlights, please visit our website at

www.capreit.ca

and our public disclosures which can be found under our profile at

www.sedarplus.ca.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this press release constitute

forward-looking statements within the meaning of applicable Canadian

securities laws which reflect CAPREIT’s current expectations and projections

about future results. Forward-looking statements generally can be identified

by the use of forward-looking terminology such as “outlook”, “objective”,

“may”, “will”, “expect”, “intent”, “estimate”, “anticipate”, “believe”,

“consider”, “should”, “plans”, “predict”, “estimate”, “forward”,

“potential”, “could”, “likely”, “approximately”, “scheduled”, “forecast”,

“variation” or “continue”, or similar expressions suggesting future outcomes

or events. The forward-looking statements made in this press release relate

only to events or information as of the date on which the statements are

made in this press release, and include statements relating to the expected

future performance of the acquisitions and the anticipated completion and

timing of the pending acquisitions. Actual results and developments are

likely to differ, and may differ materially, from those expressed or implied

by the forward-looking statements contained in this press release. Any

number of factors could cause actual results to differ materially from these

forward-looking statements. Although CAPREIT believes that the expectations

reflected in forward-looking statements are reasonable, it can give no

assurances that the expectations of any forward-looking statements will

prove to be correct. Such forward-looking statements are based on a number

of assumptions that may prove to be incorrect, including with regards to the

expected future performance of the acquisitions and the anticipated

completion and timing of the pending acquisitions. Accordingly, readers

should not place undue reliance on forward-looking statements.

Forward-looking statements in this press release are subject to certain

risks and uncertainties, many of which are beyond CAPREIT’s control, which

could result in actual results differing materially from these

forward-looking statements. These risks and uncertainties include, but are

not limited to, the risks and uncertainties described under the heading

“Risks and Uncertainties” in CAPREIT’s 2024 Annual Report and under the

heading “Risk Factors” in CAPREIT’s Annual Information Form for the year

ended December 31, 2024, each of which is available under CAPREIT’s profile

on SEDAR+ at www.sedarplus.ca.

Except as specifically required by applicable Canadian securities law,

CAPREIT does not undertake any obligation to update or revise publicly any

forward-looking statements, whether as a result of new information, future

events or otherwise, after the date on which the statements are made or to

reflect the occurrence of unanticipated events. These forward-looking

statements should not be relied upon as representing CAPREIT’s views as of

any date subsequent to the date of this press release.

For more information, please contact:

CAPREIT

Mr. Mark Kenney

President and Chief Executive

Officer

(416) 861-9404

|

CAPREIT

Mr. Stephen Co

Chief Financial Officer

(416)

306-3009

|

CAPREIT

Mr. Julian Schonfeldt

Chief Investment Officer

(647)

535-2544

|

| |

|

|

Source: Canadian Apartment Properties Real Estate Investment Trust